Investing in apartment buildings can be a lucrative venture for those looking to diversify their portfolio and generate passive income. However, it's crucial to approach this type of investment with careful consideration and strategic planning. From understanding market dynamics to managing property effectively, there are several key steps to take to ensure success in this endeavor. In this comprehensive guide, we'll explore the ins and outs of investing in apartment buildings, providing valuable insights for both novice and experienced investors.

How to Invest in Apartment Buildings?

As with any investment, it's vital to thoroughly research the market before diving in. This includes understanding the current supply and demand for apartment buildings in your desired location, as well as projected growth and development plans for the area.

1. Market Research and Analysis:

Before diving into any investment, it's essential to conduct thorough market research and analysis. This involves understanding local real estate trends, vacancy rates, rental demand, and economic indicators. Look for areas with steady population growth, strong job markets, and limited new construction, as these factors contribute to a stable rental market. Additionally, consider the demographics of the area, such as the presence of universities or corporate offices, which can influence rental demand.

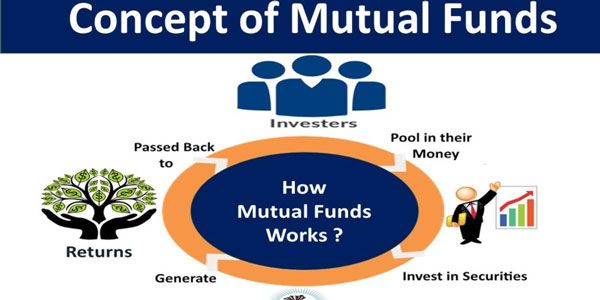

2. Financial Planning:

Calculate your budget and determine how much capital you can allocate towards acquiring an apartment building. Consider factors such as down payments, closing costs, renovation expenses, and ongoing maintenance costs. It's also important to secure financing options, whether through traditional mortgages, commercial loans, or partnerships with other investors. Work with financial advisors to assess the potential return on investment (ROI) and develop a comprehensive financial plan.

3. Property Selection:

When selecting an apartment building, look for properties that offer a balance between affordability and potential for appreciation. Consider factors such as location, property condition, unit mix, amenities, and potential for value-add opportunities. Conduct thorough due diligence, including property inspections, financial audits, and tenant interviews, to assess the property's viability as an investment.

4. Risk Management:

Mitigate risks associated with apartment building investments by diversifying your portfolio wisely across different locations and property types. Conduct thorough due diligence not only on the property itself but also on the local market trends and economic indicators. Additionally, ensure you have appropriate insurance coverage tailored to the specific risks of apartment buildings.

Consider factors such as market volatility, tenant turnover rates, ongoing maintenance costs, and regulatory compliance requirements to make informed investment decisions. It's also crucial to develop comprehensive contingency plans for unforeseen circumstances, such as economic downturns, changes in market conditions, or natural disasters, in order to safeguard and maximize the returns on your investment in apartment buildings.

5. Property Management:

Effective property management plays a crucial role in optimizing returns on investments in apartment buildings. Whether you opt for self-management or enlist the services of a professional property management company, it is vital to prioritize well-rounded property maintenance, tenant satisfaction, and maximizing rental income. By establishing streamlined rent collection procedures, ensuring prompt maintenance and repairs, and fostering proactive communication with tenants, you can effectively reduce vacancies and enhance your overall cash flow in the long term.

6. Value-Add Strategies:

Explore various value-add opportunities to increase the property's overall value and amplify its income-generating potential. Consider strategies such as renovating units to modern standards, upgrading amenities to attract tenants, implementing energy-efficient features to reduce costs, and optimizing rent rates to stay competitive in the market. It is crucial to conduct thorough cost-benefit analyses to assess the viability of these value-add projects. Prioritize initiatives that promise the highest return on investment to maximize the property's profitability in the long run.

7. Long-Term Strategy:

Developing a comprehensive long-term investment strategy for your apartment building portfolio is crucial for sustained success. This involves analyzing various factors such as asset appreciation trends, detailed cash flow projections over time, and outlining potential exit strategies. It's important to carefully consider whether your goal is to hold the property for an extended period to benefit from long-term gains or to strategize selling it at a profit after a specific duration.

8. Compliance and Legal Considerations:

To prepare for successful investments in apartment buildings, it's crucial to delve into the intricacies of local zoning laws, building codes, landlord-tenant regulations, and tax implications. By understanding these key factors, you can ensure compliance with legal requirements and make informed decisions. In cases of complex legal issues, seeking professional advice is highly recommended to navigate the intricacies effectively.

9. Continuous Learning and Improvement:

Stay updated on the latest industry trends, emerging technologies, and best practices in the realm of apartment building investing. Connect with like-minded investors, actively participate in educational seminars and workshops, and actively seek guidance and mentorship from seasoned professionals. By consistently expanding your understanding and honing your skills in the field of real estate investing, you pave the way for long-term success and growth in your ventures.

Conclusion:

Investing in apartment buildings can provide substantial opportunities for generating passive income and establishing long-term wealth. By meticulously conducting market research, creating a robust financial strategy, and employing efficient property management techniques, investors can optimize returns and minimize risks linked to this asset class. Through meticulous planning and dedicated execution, investments in apartment buildings can serve as a valuable and diversified component within any well-rounded investment portfolio. By actively staying attuned to market trends, fostering tenant relationships, and staying abreast of property maintenance, investors can further enhance the profitability and sustainability of their apartment building investments.