The "Pay Over Time" option on American Express's most popular cards makes them more like standard credit cards; this includes the American Express® Green Card, American Express® Gold Card, and The Platinum Card® from American Express.

Implemented As A Payment Method Using Credit Cards

These cards started as something other than credit cards but as charge cards. There are no spending caps or variable interest rates on charge cards like credit cards. In most cases, you can't run up a balance on a credit card; instead, you'll have to pay your balance in full every month.

However, when you use Pay Over Time, things are different since you may spread the payments for your qualified purchases over a longer period at a lower interest rate. Although this is a practical option, carrying a balance can be rather costly.

Definition of a Credit Card and a Charge Card

American Express also offers Pay Over Time for its Green, Gold, and Platinum Business Cards. Those who have those cards will also be automatically enrolled. If you use an AmEx card, your card will be enrolled automatically. There is no activation or opting in required. You are automatically enrolled in Pay Over Time if you hold an American Express® Green Card (see rates and fees), American Express® Gold Card (see rates and costs), or The Platinum Card® from American Express.

With the help of the Interest-Free Payment Plan

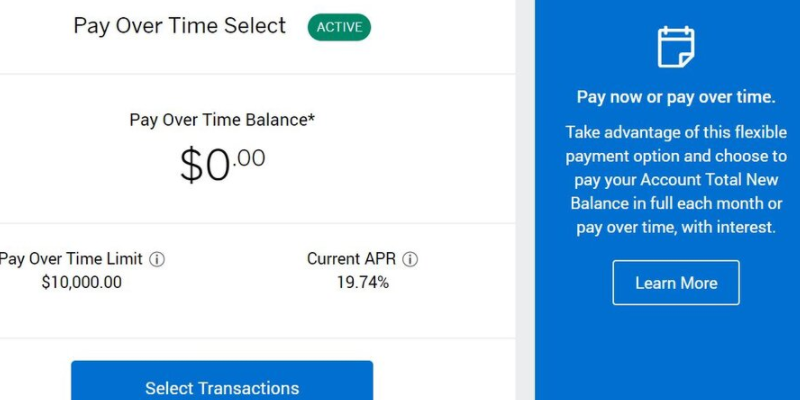

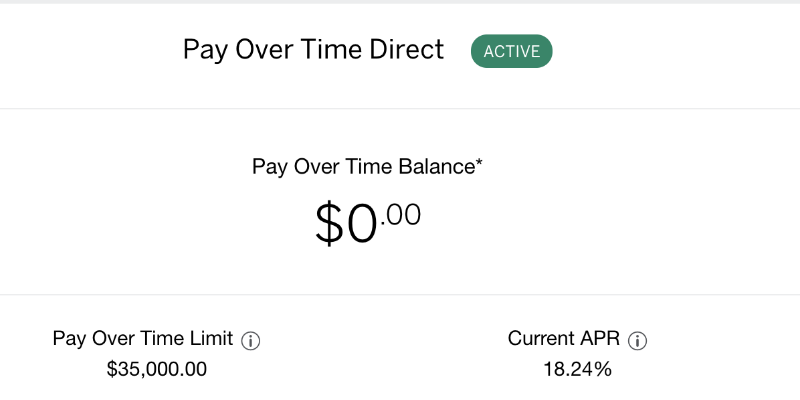

However, it would be best if you declined enrollment to avoid being charged. To do so, either go to the American Express website or call them. Limits on how much can be paid over how much time are set by the issuer. While there is no cap on how much you may spend using the card in total, there is a cap on how much you can finance using the Pay Over Time option. Your available credit is dynamic and is determined by several criteria, including the nature of your intended transaction, payment method, and credit history.

Costs that qualify for coverage are routine.

You shop as you always do. You will see eligible charges added to your Pay Over Time amount on the first of every month. As before, the card will operate normally, and no interest will be charged if the balance is paid in full by the due date each month. Whether or not you choose Pay Over Time, you will still accumulate rewards on every transaction.

Based On The Customer's Creditworthiness.

If you don't pay your bill fully, interest will be added. All three Pay Over Time tiers (Green, Gold, and Platinum) have the same interest rate. Beginning in August 2020, this service's variable annual percentage rate (APR) will range from 15.99% to 22.99%, depending on the cardholder's creditworthiness.

Possibility of Making Monthly Payments.

You can choose how to handle your bills. With Pay Over Time, you can spread your payments over a longer period. You will be paid in full, including the minimum payment necessary to maintain any outstanding Pay Over Time balance and any additional funds owed to you that are in excess of your Pay Over Time cap. If you don't want to use Pay Over Time, you can always choose to settle the balances in full.

Eligible purchases

The cards have varying spending minimums and other restrictions. The Pay Over Time option is only available for purchases of $100 or more made with the American Express® Gold Card or the American Express® Platinum Card. Any amount can be spent with the American Express® Green Card. All of the usual caveats apply.

A Guide to Maximizing Platinum Card® from American Express

Cash advances, traveler's checks, other cash equivalents, purchases made at casinos, fees payable to the issuer (save for foreign transaction fees), and some insurance premiums do not eligible for Pay Over Time. While you should avoid making large purchases on credit, the Pay Over Time option is there for those situations when you can't make a complete payment immediately.

Issues that may arise

In addition, the AmEx Pay It Plan It® function is available on all three of these cards if you need breathing room while making large expenditures. The "Plan It®" component of this service lets you spread the cost of purchases of $100 or more out over time, with a fixed monthly fee, without incurring any interest costs.